PETER PARKS / AFP / GETTY IMAGESA person passes a photomontage of the Shanghai skyline in a subway station in Pudong, the financial district of Shanghai, on Feb. 3, 2012Liu's latest book is The Gardens of Democracy: A New American Story of Citizenship, the Economy, and the Role of Government

Two years ago, China launched an ambitious campaign to lure expatriate Chinese-born scientists, engineers and entrepreneurs, particularly those in the U.S., to go home to China. This “talent development” initiative, reported the New York Times, promises free housing, tax breaks and signing bonuses of up to $158,000, and reinforces a narrative loop in the threatened American psyche: First they got our jobs, then our dollars and debt and now our talent.

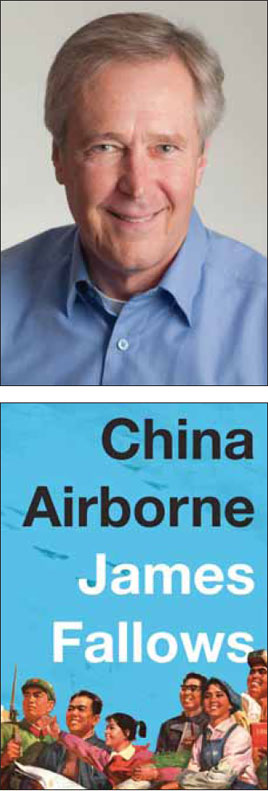

But in his new book, China Airborne, James Fallows tells a story that’s more nuanced and, in some ways, actually harder to bear. A longtime correspondent for the Atlantic who’s lived in Beijing and Shanghai, Fallows chronicles China’s efforts to create a world-class commercial-aviation sector from scratch. Assembling iPhones by hand requires only abundant unskilled labor. Making passenger jets that stay aloft requires an economy of such sophistication and interlocking complexity that it can truly be called first world. And, indeed, China’s aviation boom — with catalysts ranging from well-connected tycoons to ambitious American advisers to provincial boosters — is a microcosm of China’s epic rise. Where that country’s core assets can be brought to bear — scale, mass, will, central planning — breathtaking progress ensues. China, for instance, is building 100 new airports today; the U.S., one or two. China has created a giant aeronautical complex in Xi’an for 250,000 engineers.

(MORE: Why China’s Rise Is Great for America)

Yet the Chinese have liabilities too. Those engineers have been trained more to follow routines than to adapt creatively to the unexpected. The state’s control of the Internet stifles innovation. The reluctance of the People’s Liberation Army to relax its grip on airspace deters aerospace entrepreneurs. The culture of self-dealing state capitalism makes foreign investment risky. The absence of transparent governance and public trust dampens citizen initiative.

These liabilities often go unnoticed by Americans because it’s harder to see the soft stuff (like culture) than the hard (like infrastructure). For the same reason, Americans are often blind to their own strengths. I write this from Seattle, which remains the aviation capital of the world — and likely will for the rest of our lives. Here America’s assets are hidden in plain sight: its research universities, its venture-capital ecosystems, its Boeings and Microsofts, its immigrants of all races and classes, its relatively open government, its web of voluntary associations.

(MORE: China’s Going to the Moon — and That’s Good for Everyone)

But then, in the other Washington and on Wall Street, America’s liabilities lie also in plain sight. The body politic is crippled by severe, asymmetrical party polarization. CEOs and shareholders are obsessed with quarterly results instead of long-term economic health. Bankers still believe that financial engineering is engineering and that making a casino killing is the same as creating social value.

It turns out that a much earlier work by Fallows may bear the more apt message for our times. Back in the late 1980s, when Japan was rising and predictions of American decline were rampant, he wrote that instead of wringing our hands and trying to be more like the Japanese, what we needed was to be — in the title of his book — More Like Us. We had to remember that America’s advantage, when activated, was its openness to talent from outside, its social mobility, its institutional support for equal opportunity, its amalgam of individual moxie and mutual responsibility, its tolerance for change and risk, its essential pragmatism.

We know how that story ended: America rebounded, and Japan, because of its own underappreciated weaknesses, fell into a “lost decade.” How today’s story will end is still in question. What’s certain is that Americans should be less alarmed by reports of China’s methods than by reports of America’s underfunded universities, its money-drenched ideological politics, its concentration of wealth and the meanness and myopia of its immigration policies. These things — not China’s 12th Five-Year Plan or $158,000 signing bonuses — are what threaten American prosperity.

(MORE: Will Events in China Have a Lasting Impact on Obama?)

It’s worth remembering too that the transformation China must now make to create an economy with topflight jobs is much more wrenching than the transformation America must make to keep such an economy. The difference is civic: a society’s talent is developed much more readily when institutions and incentives tip toward openness and freedom. And it’s much harder to create such institutions than to renew them.

As Fallows observes, leaders in China aren’t preoccupied with the U.S.; they are busy trying to hold their own centrifugal, contradictory society together. But they surely note even today the rich evidence of insistent American innovation: from SpaceX’s rocket launch to James Cameron’s deep-ocean dive to the Nobel laureates who still populate America’s research institutions and are exploring the frontiers of nanorobotics and brain science and the mysteries of the genome.

So let China take flight and let them do it their way. We can’t out-China China. But we can be more like us — and we’d better, in a hurry.

MORE: Murder, Lies, Abuse of Power and Other Crimes of the Chinese Century

Liu is the author of several books, including The Gardens of Democracy and The Accidental Asian. He was a speechwriter and policy adviser to President Clinton.

This is a great piece on the under-appreciated differences between the US economy and our rising Chinese counterpart. Great stuff. Here is my favorite excerpt;

"...Americans are often blind to their own strengths. I write this from Seattle, which remains the aviation capital of the world — and likely will for the rest of our lives. Here America’s assets are hidden in plain sight: its research universities, its venture-capital ecosystems, its Boeings and Microsofts, its immigrants of all races and classes, its relatively open government, its web of voluntary associations."